Override Veto

Jackson, Mississippi

The State Capital of Mississippi

Monday morning, February 6, 2006

Mike Sawyer awaits for the state elected officials

The Mississippi House and Senate go in session at 4:00 PM on this Monday

The following is from the federal Centers for Disease Control and

Prevention:

http://www.cdc.gov/nccdphp/publications/factsheets/ChronicDisease/mississippi.htm

Mississippi’s cardiovascular disease (CVD) mortality rate

is the highest in the nation: in 2000, the state’s CVD mortality rate was 29%

higher than that of the United States. More Mississippians die each year from

CVD than from all types of cancer, traffic injuries, suicides, and AIDS

combined. In addition, 1 in 5 Mississippians under 64 died of CVD.

In 2001, Mississippi had the highest heart disease death rate in the nation

and the 5th highest stroke death rate.

As the state’s population ages, the economic impact of CVD on Mississippi’s

health care system continues to grow. In 2001, the estimated cost of CVD in

Mississippi was about $3.7 billion.

Smoking, obesity and physical activity are three risk

factors that are modifiable through behavior changes. According to 2003 data

from CDC’s Behavioral Risk Factor Surveillance System, more than a quarter of

adults and almost a quarter of high school students in Mississippi smoked.

See more pictures of

Mike Sawyer and his two public mission days in Mississippi

(Panel of judges for MVP selection

include all tobacco CEOs.)

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060330/OPINION01/603300354/1008/OPINION

March 30, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

March 30, 2006

Tax bill: Senators choose tobacco over food

Remember Gov. Haley Barbour and 20 members of the state

Senate when you go to the grocery store because they will be right there with

you.

When you are standing in that checkout line and the bill

is totaled, look at the last item. It is the 7 percent sales tax added to your

bill. Had these 20 senators not joined with the governor Wednesday in supporting

his veto, that tax bill would have been cut in half and you would be leaving the

store with more money in your pocket.

Because of Gov. Barbour and this group of 20 senators, you

will continue to pay the highest sales tax on food in the country. While many

states have moved to remove or reduce this most regressive tax, these senators

have decided Mississippians need to pay it.

Why? Just look up from your grocery bill and you will see.

Just glance over at the rows of cigarette cartons behind the cashier. Because of

Gov. Barbour and these 20 senators, the Big Tobacco companies selling those

cigarettes will get the tax break you might have gotten. They will continue to

enjoy the second lowest tax in the country.

The Senate's failure to support Lt. Gov. Amy Tuck's

progressive tax swap plan is a setback to families.

This bill should have passed. Mississippi, the poorest

state in the nation, has no business charging the highest sales tax on food.

Mississippi has no business having a tax policy that gives the break to a

product that is harmful and ends up costing all taxpayers, smokers or not.

Gov. Haley Barbour and these 20 senators had a clear

choice and they chose tobacco instead of food. They chose a tax policy that

favors tobacco companies over families. It was a bad choice.

So, remember these senators when you go to the grocery

store. Cut this out and put it on your refrigerator at home so you can think of

them while you are putting up the milk and the eggs. Because of them, you just

paid more for your food than you should.

And, it's a crying shame.

ROLL CALL VOTE

The Mississippi Senate on Wednesday, on a 29-20 vote,

failed to override Gov. Haley Barbour's veto of a bill that would have increased

the cigarette tax and cut the state sales tax on food in half, from 7 percent to

3 1/2 percent.

The vote would have taken 33 votes to prevail and allow the bill to become law.

Voting to override the governor's veto were (29): Sens. Nickey Browning,

D-Ecru; Terry Burton, R-Newton; Hob Bryan, D-Amory; Kelvin Butler, D-Magnolia;

Videt Carmichael, R-Meridian; Deborah Dawkins, D-Pass Christian; Bob Dearing,

D-Natchez; Hillman Frazier, D-Jackson; Tommy Gollott, D-Biloxi; Jack Gordon,

D-Okolona; Alice Harden, D-Jackson; Cindy Hyde-Smith,D-Brookhaven; Gray Jackson,

R-French Camp; Robert Jackson, D-Marks; Sampson Jackson, D-DeKalb; David Jordan,

D-Greenwood; Tom King, R-Petal; Ezell Lee, D-Picayune; Travis Litte, R-Corinth;

Nolan Mettetal, D-Sardis; Alan Nunnelee, R-Tupelo; Lynn Posey, D-Union Church;

Tommy Robertson, R-Moss Point; BillyThames, D-Mize; Joseph Thomas, D-Yazoo City;

GrayTollison, D-Oxford; Bennie Turner, D-West Point; Johnnie Walls,

D-Greenville; Gloria Williamson, D-Philadelphia.

Voting against the override were (20): Sens. Sidney Albritton,

R-Picayune; Mike Chaney, R-Vicksburg; Eugene Clarke, R-Hollandale; Scottie

Cuevas, D-Pass Christian; Doug Davis, R-Hernando; Ralph Doxey, D-Holly Springs;

Merle Flowers, R-Southaven; Billy Hewes, R-Gulfport; John Horhn, D-Jackson; Dean

Kirby, R-Pearl; Perry Lee, R-Mendenhall; Walter Michel, R-Jackson; Tommy Moffatt,

R-Gautier; Ed Morgan, R-Hattiesburg; Stacey Pickering, R-Soso.; Charlie Ross,

R-Brandon; Willie Simmons, D--Cleveland; James Walley, D-Leakesville; Richard

White, R-Terry; J.P. Wilemon Jr., D-Belmont.

Absent or not voting (2): Sens. Terry Brown, R-Columbus; Bunky Huggins,

R-Greenwood.

The Student Printz student newspaper

Southern Mississippi University

Hattiesburg, Mississippi

Opinions

Victory for Big Tobacco continues hardship for others

By Andy Johnson

March 23, 2006

What's the difference between a stubborn mule and Mississippi's

governor? A mule has mind of his own and doesn't speak with a slurred

southern draw.

Last week, Haley Barbour fulfilled his yearlong promise to veto the

recently passed cigarette and grocery tax bill. It was a real bonehead

move. The bill would have cut Mississippi's grocery tax by 50 percent and

simultaneously increased the cigarette tax to 80 cents per pack.

Currently, the state's 7 percent grocery tax remains one of the highest in

the nation while the state's cigarette tax - 18 cents per pack - remains

one of lowest in the nation. According to the Federation of Tax

Administrators, Mississippi's cigarette tax is the second lowest in the

nation. To wit, the highest cigarette tax in the U.S. is $2.46 per pack in

Rhode Island.

The governor's decision to veto the bill illustrates his lack of

compassion for the poor and his continued loyalty to Big Tobacco. I guess

Barbour will always be a tobacco lobbyist at heart.

The current grocery tax is regressive - meaning it affects the poor

more the rich. Since a poor individual or family has less income, and

since every person has to buy groceries, the grocery tax constitutes an

additional burden on the poor. A poor person has to dedicate a greater

percentage of his or her income to covering the grocery tax, whereas a

rich individual hardly notices the grocery tax.

In a letter from the governor's office dated Jan. 18 of 2006, Barbour

claimed the legislators were acting on misinformation. Barbour vetoed the

proposed tax cut because it would have supposedly resulted in a $1.5

billion loss over nine years or $170 million annually. If this estimate is

true, Mississippi's tax base is terribly inefficient. Indeed, over 40

percent of the state's tax revenue comes from sales. Additionally, over 30

percent comes from individual income taxes.

Corporate tax revenue comprises only 10 percent of the state's total

revenue. Barbour's projected annual loss would constitute 10 percent of

revenue from sales tax and 5 percent of the state's total revenue.

March 23, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060323/OPINION01/603230402/1008/OPINION

Tax swap

Big Tobacco 1, Miss. Families, 0

|

|

|

TAX BREAK

Voters should call their senator at (601) 359-3770 and say they want a

tax break on food.

|

|

Following the Mississippi's Senate's failure Wednesday to

override Gov. Haley Barbour's veto of a tax swap on food and tobacco, it's Big

Tobacco 1, Mississippi Families, 0.

Senate Bill 2310 that Barbour had vetoed and the Senate on

Wednesday fell six votes shy of overriding, 28-22, was the more up-or-down

version of two bills for a tax swap.

It would have increased the cigarette tax to 75 cents in

July and $1 the next year. It also would have phased out the 7 percent grocery

tax by 2014. It originally passed the Senate by a veto-proof 36-15 vote, two

more than needed for an override.

Senators who flip-flopped on approving SB 2310 are hiding

behind Barbour's stance that tax revenue figures are unreliable and can't prove

that it won't harm tax collections in small towns. But many who initially

opposed the bill for those reasons now say they are satisfied with Senate Bill

3084, a measure crafted to address Barbour's concerns.

Barbour has also vetoed Senate Bill 3084 that would raise

the cigarette tax to $1 per pack over two years and cut the state's 7 percent

grocery tax in half. It next could be up for an override vote. And senators who

flip-flopped on SB 2310 won't have anywhere to hide if they flip-flop again.

Stay tuned; that vote could come today.

Either bill would save Mississippi families hundreds of

dollars per year on taxes spent on food they could have used (and been taxed on)

for other items, such as children's clothing, rent or gasoline.

Mississippi, the poorest state, now has the highest

grocery tax in the nation and one of the lowest cigarette taxes.

Shifting the food tax to the cigarette tax would help

deter young people from taking up the smoking habit and would have helped reduce

the millions of tax dollars Mississippians now pay on smoking-related health

care.

But 22 senators voted for keeping cigarette taxes low and

grocery taxes high:

Sens. Sidney Albritton R-Picayune; Terry Brown,

R-Columbus; Videt Carmichael, R-Meridian; Mike Chaney, R-Vicksburg; Eugene

Clarke, R-Hollandale; Scottie Cuevas, D-Pass Christian; Doug Davis, R-Hernando;

Ralph Doxey, D-Holly Springs; Merle Flowers, R-Southaven; Billy Hewes,

R-Gulfport; John Horhn, D-Jackson; Dean Kirby, R-Pearl; Perry Lee, R-Mendenhall;

Walter Michel, R-Jackson; Tommy Moffatt, R-Gautier; Ed Morgan, R-Hattiesburg;

Stacey Pickering, R-Soso; Charlie Ross, R-Brandon; Willie Simmons, D-Cleveland;

James Walley, D-Leakesville; Richard White, R-Terry; J.P. Wilemon Jr.,

D-Belmont.

Six senators voted originally for the tax break on

groceries, but flip-flopped to support the governor's veto.

The flip-floppers are: Sens. Albritton, Carmichael,

Chaney, Horhn, Lee, Simmons and Walley. Voters should ask them why they would

want to keep the sales tax on groceries high and tobacco taxes low.

(On the Web: See Senate Bill 3084:

http://billstatus.ls.state.ms.us/2006/html/select.htm)

March 23, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060323/OPINION/603230349/1009

March 23, 2006

Guv puts tobacco ahead of citizens

I am an independent/Republican who supported Gov.

Barbour.

He did a great job in handling the Katrina

problems.

The cigarette/grocery tax seemed to be a

no-brainer and was popular with voters.

I can only conclude the governor puts tobacco

companies ahead of the citizens of Mississippi.

Joe T. Reeves

Carthage |

|

Posted on Wed, Mar. 22, 2006

http://www.sunherald.com/mld/sunherald/news/politics/14162120.htm

Senate fails to override first cigarette-tax veto

EMILY WAGSTER PETTUS

Associated Press

JACKSON, Miss.

- One cigarette and grocery tax bill is dead, dead, dead for this

legislative session.

Later this week, another one could either take its final gasps or gain new

energy and be pushed into law.

In a surprise move Wednesday, the Mississippi Senate tried - and failed - to

override Gov. Haley Barbour's January veto of a bill that would increase taxes

on cigarettes and eliminate them on groceries.

Mississippi has the highest state grocery tax rate in the nation, at 7

percent. It also has one of the lowest cigarette excise taxes, at 18 cents a

pack.

Because the veto had sat untouched for two months, many lawmakers had assumed

there would be no attempt to override and the bill would fade away when the

session ends April 2. Cities receive part of the sales taxes collected within

their boundaries, and many mayors had sharply criticized the bill because they

feared it would hurt local budgets.

After nearly two hours of debate Wednesday, the Senate voted 28-22 in favor

of an override. But, that was six votes shy of the 34 needed for a two-thirds

majority.

Sen. Billy Thames, D-Mize, pleaded with his colleagues to push the bill into

law to help working Mississippians. The measure would've cut the grocery tax in

half this July 1, then phased out the remaining 3.5 percent over several years.

It also would've raised the cigarette excise tax to 75 cents a pack this July 1

and $1 a pack a year later.

"The vast majority of the people I represent struggle to make a living,"

Thames said. "They struggle to survive."

But, Sen. Billy Hewes III, R-Gulfport, said the state still faces a long

recovery from Hurricane Katrina. He argued that lawmakers should support

Barbour's veto.

"I think this is a dangerous thing to be taking on right now," Hewes said of

the tax bill.

Barbour said in a written statement later: "With this large margin to sustain

the veto, I hope we can put this risky tax scheme behind us."

Senators this week could try to override Barbour's veto of a second tax bill.

It would cut the grocery sales tax in half and increase the cigarette excise tax

to 80 cents a pack this July 1 and to $1 a pack a year later.

Barbour vetoed the second bill last week, saying the state should not change

its tax structure while it's still seeking federal Katrina money.

Critics have said that Barbour, a former tobacco lobbyist in Washington, is

trying to help cigarette makers.

Senate Finance Chairman Tommy Robertson, R-Moss Point, said his committee

this week likely will start working toward overriding Barbour's veto of the

second tax bill.

Robertson said he didn't know if there will be enough votes to override - but

supporters could have a tough time. The second bill passed the Senate 29-19 on

March 3, with three absent.

Lt. Gov. Amy Tuck proposed the original cigarette and grocery tax bill,

creating her first public rift with fellow Republican Barbour. She said she

hopes lawmakers will override the second veto.

"I've worked in a country store. I've seen people go and have to put items

back because they couldn't afford them," Tuck said. "And so, to give a break to

the working men and the working women of this state is the right thing to do."

The first bill passed the Senate 36-15 in January. Three Democrats and four

Republicans who originally supported the bill flipped their votes Wednesday. One

Republican was absent.

The senators who flipped were Democrats John Horhn of Jackson, Willie Simmons

of Cleveland and Shannon Walley of Leakesville; and Republicans Sid Albritton of

Picayune, Videt Carmichael of Meridian, Mike Chaney of Vicksburg and Perry Lee

of Mendenhall.

Sen. Robert "Bunky" Huggins, R-Greenwood, voted for the bill in January but

was absent Wednesday.

---_

The bills are Senate Bills 2310 and 3084.

March 15, 2006

Text of governor's veto message

Special to The Clarion-Ledger

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060315/NEWS/60315013

TO THE MISSISSIPPI STATE SENATE:

I am returning SB 3084: "AN ACT TO AMEND SECTION 27-69-13, MISSISSIPPI CODE OF

1972, TO INCREASE THE EXCISE TAX ON CIGARETTES; TO AMEND SECTION 27-65-75,

MISSISSIPPI CODE OF 1972, TO INCREASE THE PERCENTAGE OF SALES TAX COLLECTED ON

RETAIL SALES OF SUCH FOOD WITHIN MUNICIPALITIES THAT IS DISTRIBUTED TO

MUNICIPALITIES, AND TO REQUIRE A PORTION OF THE MONTHLY TOBACCO TAX REVENUE TO

BE DEPOSITED IN THE EDUCATION ENHANCEMENT FUND AND THE SCHOOL AD VALOREM TAX

REDUCTION FUND; TO AMEND SECTION 27-69-31, MISSISSIPPI CODE OF 1972, TO PROVIDE

FOR A DISCOUNT ON THE ADDITIONAL FACE VALUE OF STAMPS PURCHASED TO COMPLY WITH

CERTAIN CIGARETTE EXCISE TAX INCREASES; TO CREATE A NEW SECTION 27-65-26,

MISSISSIPPI CODE OF 1972, TO IMPOSE A SEPARATE SALES TAX LEVY ON RETAIL SALES OF

CERTAIN FOOD FOR HUMAN CONSUMPTION AND TO REDUCE THE SALES TAX RATE ON SUCH

FOOD; TO AMEND SECTION 27-65-17, MISSISSIPPI CODE OF 1972, IN CONFORMITY

THERETO; TO IMPOSE A FEE ON NONSETTLING-MANUFACTURER CIGARETTES; TO REQUIRE

MONTHLY REPORTING OF THE NUMBER AND DENOMINATION OF STAMPS AFFIXED TO PACKAGES

OF NONSETTLING-MANUFACTURER CIGARETTES, THE NUMBER OF INDIVIDUAL PACKAGES OF

NONSETTLING-MANUFACTURER CIGARETTES SOLD OR PURCHASED IN THIS STATE OR OTHERWISE

DISTRIBUTED IN THIS STATE FOR SALE IN THE UNITED STATES AND ANY OTHER

INFORMATION THE STATE TAX COMMISSION CONSIDERS NECESSARY OR APPROPRIATE TO

DETERMINE THE AMOUNT OF THE FEE IMPOSED BY THIS ACT OR TO ENFORCE THIS ACT; TO

REQUIRE REGISTRATION OF NONSETTLING MANUFACTURERS WITH THE ATTORNEY GENERAL; TO

REQUIRE DEVELOPMENT, MAINTENANCE AND PUBLICATION BY THE ATTORNEY GENERAL OF A

LIST OF NONSETTLING MANUFACTURERS THAT HAVE CERTIFIED THEIR COMPLIANCE WITH THIS

ACT; TO PROVIDE FOR ENFORCEMENT OF THE REQUIREMENTS IMPOSED BY THIS ACT; TO

GRANT PROTECTIONS FROM CIVIL LIABILITY TO NONSETTLING MANUFACTURERS THAT COMPLY

WITH THE PROVISIONS OF THIS ACT; AND FOR RELATED PURPOSES" without my approval

and assign the following reasons for my veto.

After full consideration, I am vetoing Senate Bill 3084, which proposes to

reduce the sales tax on groceries and increase the tax on cigarettes. Senate

Bill 3084 is the latest attempt by the Legislature to change the state revenue

stream in the middle of tremendous financial uncertainty in the wake of

Hurricane Katrina. Reliable, accurate information needs to be developed through

proper research before such a tax shift is enacted, but this research has not

been done.

In the first week of this session of the Legislature, the Senate passed Senate

Bill 2310, with the promise of revenue neutrality for the state General Fund and

for our cities and towns, and the House soon followed. Before I could act on

this bill, the House Ways and Means Committee realized the claim was inaccurate

and passed House Bill 1140 to increase the level of reimbursements to the

municipalities, at the expense of the General Fund. However, even the higher

reimbursements of House Bill 1140 were not enough to keep the municipalities

whole.

I vetoed Senate Bill 2310 on January 18, 2006, because it would have resulted in

a loss of some $1.5 billion revenue to the state over nine years and would have

cut sales tax revenues to municipalities by more than $150 million over nine

years. These revenue losses would have inevitably led to lower funding for

education and basic services as well as to tax increases, ranging from municipal

ad valorem taxes to sales tax increases on products other than groceries to

higher income taxes.

After I vetoed Senate Bill 2310, the Senate passed the first version of Senate

Bill 3084, again with the claim of revenue neutrality for both the state General

Fund and for our cities and towns. The same day, the House passed a different

proposal, House Bill 1634, also claiming revenue neutrality. To the credit of

the House, House Bill 1534 was the first of the four pieces of legislation which

actually held municipalities harmless from the effects of the risky tax swap.

However, this was achieved by an increased diversion from the General Fund, and

therefore, a larger reduction in state revenue.

The conference report of Senate Bill 3084 is now the fifth version of the tax

swap the Legislature has considered, and its proponents again claim it is

revenue neutral. This legislation would cut the sales tax on groceries from 7%

to 31/2%; increase the excise tax on a pack of cigarettes from 18 cents to 80

cents on July 1, 2006, and from 80 cents to $1 on July 1, 2007; and establish an

additional fee of 43 cents/pack on cigarettes produced by manufacturers which

did not participate in the tobacco settlement in the 1990's, in exchange for

immunity from future lawsuits. The fee on the non-settling manufacturers would

increase each year by at least 3%.

Senate Bill 3084 as sent to me is not revenue neutral. It will result in lost

revenue to the General Fund, and the revenue reduction will increase in the out

years. In this time of financial uncertainty, when we continue to seek

additional federal assistance to help us recover and rebuild from Katrina, it is

irresponsible to cut our own tax revenue, no matter how well intentioned.

In each version of these tax proposals, the supporters of the tax swap concept

promise revenue neutrality, but they still do not take into account factors

which will cause a net revenue reduction over time. The Legislature is relying

on figures supplied by the State Tax Commission, but as its Chairman has pointed

out repeatedly, the State Tax Commission has no expertise in estimating future

revenue growth rates. Therefore, its estimates are in current dollars and do not

take into account the fact that Senate Bill 3084 would replace a growing revenue

source (sales tax on groceries) with a declining revenue source (cigarette tax).

For example, when the supporters of this bill claim it is revenue neutral, they

claim the sales tax on groceries will generate the same amount of revenue five

years from now as it generates today. The possibility of that happening is

virtually zero. Sales tax collections have increased 5% each year over the last

ten years.

When the supporters of this bill claim it is revenue neutral, they claim that a

10% increase in cigarette prices will cause a 4% reduction in taxable packs

sold. However, they do not take into account the recent history of declining

smoking rates in Mississippi and across the country. Last week the Washington

Post reported that "Americans smoked fewer cigarettes last year than at any time

since 1951, and the nation's per capita consumption of tobacco fell to levels

not seen since the early 1930's." Nationally, smoking declined 4.2% in 2005

alone and declined 20% in the last six years.

Cigarette smoking and tax revenue have been declining in Mississippi in

recent years, with no change in the tax. Cigarette smoking and tax revenue from

cigarette sales will decline at a much faster rate if the tax is raised as

proposed in SB 3084. Indeed, that is the chief goal of many of the bill's

supporters, which is a worthy goal. Yet the legislative proponents greatly

underestimate this reduction in tax revenue, which must explain why no fiscal

note for the bill, setting out the revenue estimate, was provided beyond years

one and two. Every year going forward the reduction in revenue - the loss to the

state's programs - will be greater and greater. This is bad policy, especially

now.

Last week, when I testified before the Senate Appropriations Committee about

Mississippi's needs to recover and rebuild from Katrina, I was asked if our

state has cut its taxes and its state revenue in the aftermath of the hurricane.

I was told publicly this question had been asked of the Committee. Because of my

veto of SB 2310, I truthfully answered that we had not cut our taxes or our

revenue. After today's veto, that

answer will still be accurate.

Beyond all the other reasons I've mentioned, this bill must be vetoed if we are

to have any credibility when we seek the assistance of the federal government

and the American people in our recovery and rebuilding. Any legislator ought to

recognize that is true.

I remain opposed to raising anybody's taxes, but even those who disagree should

see why this bill must be vetoed.

If the Legislature would like to have a study to determine the details of our

revenue collections, I will go along. The fact is, the State Tax Commission has

consistently said it does not even know the amount of sales tax collected on

groceries today, so it (and no one else) cannot say if a different revenue

stream would be sufficient to replace the sales tax on groceries.

Knowing the facts is critical before making a decision that involves hundreds of

millions of dollars a year - money that citizens depend on for schools,

colleges, law enforcement and other state services. Knowing the facts is even

more crucial in a time of uncertainty, in which we Mississippians find

ourselves.

We do not need to add to that uncertainty by enacting the latest version of a

tax scheme just because it may be politically popular.

For these reasons, I urge the members to sustain the veto and reject Senate Bill

3084.

Why not help Mississippi families?

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060315/OPINION01/603150331

March 15, 2006

Jackson, MS

|

|

|

FOOD TAX CUT

Cutting the food tax would help Mississippi families save

hundreds of dollars per year in money that could be spent

elsewhere, and taxed - from manufactured items, to clothing for

schoolchildren, to even a meal out for the family.

|

|

Gov. Haley Barbour has a clear choice to make

today on whether Mississippians will get a break on food or cigarettes

when it comes to taxes.

Today is the deadline concerning Senate Bill

3084, which would raise cigarette taxes and lower groceries. The

governor can sign it into law, veto it or let it become law without his

signature. Barbour should sign it.

The bill offered by Lt. Gov. Amy Tuck would

raise cigarette taxes by 80 cents this year and to $1 next year. That

would offset cutting the sales tax on groceries in half, from 7 percent

to 3 1/2 percent.

SB 3084 is not as good a tax cut as an original

bill vetoed by Barbour that would eliminate the sales tax on groceries

by 2014 but it would help.

Cutting the food tax would help Mississippi

families save hundreds of dollars per year in money that could be spent

elsewhere, and taxed - from manufactured items, to clothing for

schoolchildren, to even a meal out for the family.

It's unconscionable that the poorest state in

the Union has one of the highest taxes on food - while, paradoxically,

having one of the lowest taxes on cigarettes.

Thirty-eight states exempt food in some form

from sales taxes; Mississippi has the second-lowest cigarette tax.

Barbour's oft-repeated phrase that he's not for

raising anyone's taxes just doesn't wash with this situation. It's less

of a tax "hike" than a tax "swap."

Why not help families put food on the table?

Why not tax a product that runs up the state's health care bills?

People can choose not to smoke but people have

to eat. So, Barbour has a tax choice - food or cigarettes. Which will it

be?

|

|

| |

| Subject: |

re: CORE-Your position on Gov. Haley

Barbour's veto of Tax Swap Bill |

| Date: |

3/5/2006 6:43:18 A.M. Central Standard Time |

| From: |

Tobaccokills2000 Tobaccokills2000 |

|

|

Congress of Racial

Equality

817 Broadway

New York, New York

10003

(212) 598-4000

Fax - (212)

598-4141

Please let me know your position on Governor Haley Barbour of Mississippi

and his veto of the Tax Swap Bill that would have abolished the 7 percent

sales tax on food and groceries and placed an additional tax on cigarettes.

The Meridian Star

Meridian, Mississippi

Letters to the Editor

http://www.meridianstar.com/opinion/local_story_069000155.html?keyword=topstory

Published: March 10, 2006 12:01 am

Cigarette/grocery tax legislation is no-brainer

It is inconceivable to me that anyone would object to cutting taxes on food

and raising taxes on cigarettes.

Cutting taxes on food would be a boon to everyone, especially the poor.

Increasing the tax on cigarettes might keep some young people from taking up

the habit.

Those people who are already addicted to the nicotine in cigarettes will find

a way to pay for them. However, a tax increase might be an incentive to quit

smoking completely.

Nina McKee

Decatur

The Meridian Star

Meridian, Mississippi

http://www.meridianstar.com/editorials/local_story_060082358.html

Published: March 01, 2006 08:23 am

Compromise tax bill should pass

New bills to increase Mississippi's cigarette tax and reduce its grocery

tax are imperfect but much improved over a bill vetoed by Gov. Haley Barbour

earlier in the legislative session.

March 8, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060308/OPINION/603080366

Will Barbour stop a real tax cut?

The Legislature has responded to Gov. Haley Barbour's

veto of a bill to raise cigarette taxes and do away with the sales tax on food

by approving another bill that answers concerns that such a move may harm city

budgets.

The new bill, approved by the Senate Friday and House

Monday, would raise cigarette taxes by 80 cents this year and $1 next year.

That increase in revenue would offset cutting the sales tax on groceries in

half, from 7 percent to 3 1/2 percent. It is not as good a tax cut as the

original bill, but would help. The question is will Barbour veto this one,

even though it answers his major objections on city finances?

The Tuscaloosa News

Tuscaloosa, Alabama

February 12, 2006

http://www.tuscaloosanews.com/apps/pbcs.dll/article?AID=/20060212/NEWS/602120338&SearchID=73236832271952

Dear Editor: If [Mississippi] Gov. Haley

Barbour runs for president, I sure hope that all health-conscious Americans will

be aware of his life working against the health and well being of humanity as a

tobacco lobbyist.

What part of guilt should Gov. Barbour have for the 4,961 tobacco related deaths

in Mississippi as reported by the federal Centers for Disease Control for 1999?

When will the preachers and political parties of Mississippi and America cast

shame on anyone who associates with promoting legal and lethal tobacco?

I would walk, roller blade, and bicycle from Birmingham, Alabama to Jackson,

Miss., if Gov. Barbour ever schedules a press conference to publicly apologize

to humanity for promoting the legal product that slaughters 450,000 Americans

every year.

After his humble apology, forgiveness would give me the joy and passion to help

Gov. Barbour with his political campaign for president.

Mike Sawyer

Executive director, I Will Never Use Tobacco, Inc.501 (c) 3

Birmingham

Hypocrisy on

grocery/tobacco tax read this at:

March 1, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060301/OPINION/603010307/1009

My response to the Clarion-Ledger

| Subject: |

re:Hypocrisy on grocery/tobacco tax, my

reponse |

| Date: |

3/1/2006 6:30:24 A.M. Central Standard Time |

| From: |

Tobaccokills2000 Tobaccokills2000 |

|

|

I encourage Mr. Jim Wright to be sure to apply for a permit if he wants to

march around the State Capitol protesting the Governor's Tax Swap bill veto.

This permit requires five days to process for approval.

Not sure about the cost of permit. However I will pay the fee if Mr. Wright

feels led to represent all healthy souls in Mississippi who practice fitness

by not smoking and deserve no sales tax on food and groceries.

Phone number for more information is 601-359-3630.

With compassion,

February 19, 2006

The Clarion-Ledger Newspaper

Jackson, Mississippi

Has Barbour convinced you a grocery tax

cut is a tax hike?

By David Hampton

Just how good is Gov Haley Barbour at

politics? I never cease to be amazed.

I don't know of anybody who could

make voters believe a proposal to do away with the sales tax on groceries is

somehow a bad idea by any stretch of the imagination.

Read the rest of this editorial at:

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060219/COL0408/602190310

What job

would you not to for a million dollars?

Yesterday February 15, 2006, while listening to WJOX 690 AM one of Alabama’s

largest sports radio station in Birmingham, the two talk show host asked

their “Shot at the Buzzard,” question.

What job would you not to for a million dollars?

I contemplated about calling while listening to others call in

their answers below.

“I would not work for Satan.”

”I would not go hunting with Dick Cheney.”

”I would not be a college coach in the north, because of recruiting in

the snow.”

They hooked me.

I called.

The radio host asked, "Tell us Mike what job you would not do for a million

dollars?"

"TOBACCO LOBBYIST."

"Hey those guys make a million dollars a week," the host volleyed

back.

After my answer the last caller answered:

“I would not be a defense attorney for s_____ ball Richard Scrushy.”

The radio host said live on the air, "Hey those guys

make a millions dollars a week, too."

What job would you not do for a million dollars?

With

compassion,

Mike Sawyer

Executive Director

I Will Never Use Tobacco, Inc.501 (c) 3

Www.IWillNeverUseTobacco.com

205-515-1560

6401 Colony Park Drive

Birmingham, Alabama 35243

TobaccoKills2000@aol.com

"Let's look for every opportunity to publicly spotlight and

shame tobacco," Mike Sawyer.

Mike Sawyer

Jackson, Mississippi

Super Bowl Sunday

February 5, 2006

Mike

Sawyer's encounter with the Mississippi State Capitol police on February 6, 2006

Override Veto prayer request rejected by Mississippi church secretary

Override Veto prayer request accepted my International Catholic television

station

Jesus cared about more than souls

Tuscaloosa News newspaper

Tuscaloosa, Alabama

Carol L. Hess, Chief Warrant Officer 4 (Ret.)

Ozark

March 01. 2006 3:30AM

Dear Editor: Tony Demonbreun’s letter (Feb. 2) begins, “Lee Keyes’ letter to

the editor in the Sunday edition of The Tuscaloosa News demonstrates an

ignorance that exists among most people with regard to Christianity."

He says Christians should be concerned about saving souls and not about

motor vehicle accidents, poverty, etc. He doesn’t tell us where he did the

poll that tells him what “most people" believe. I am often amazed at how

many people who loudly proclaim their Christianity talk down to others who

may have a different insight on the holy Scriptures.

Since Christians aren’t supposed to be concerned about poverty, etc., I

suppose we are to think that Jesus made a mistake when he put so much

emphasis on these things. You may recall he didn’t tell the rich young ruler

to become a preacher. Instead, the ruler was told to sell what he had and

give it to the poor and follow Jesus.

When Jesus preached to 5,000, he was concerned when they were hungry. He

knew that people aren’t able to listen to even the best preacher if they and

their children are hungry.

I agree that Jesus didn’t say anything about motor vehicle accidents.

However, I believe he would be concerned that we are killing more people on

our highways each month than the terrorists did on Sept. 11. I think he

would have a few words for our president, governor, and legislatures who

ignore this carnage that could be greatly reduced.

The Clarion-Ledger Newspaper

Jackson, Mississippi

http://www.clarionledger.com/apps/pbcs.dll/article?AID=/20060201/OPINION/602010361&SearchID=73234677657670

February 1, 2006

Mike Sawyer has letter to editor in the Clarion-Ledger

newspaper

Miss. tobacco tax hike try courageous

Thanks from an outsider who has been fatherless by tobacco since age 11

for your continuing editorial support for the new tobacco tax to replace your

food and grocery tax ("City budgets: Mayors should not wreck tax shift," Jan.

26).

| What a

blessing it will be to see the low-income people of Mississippi get

financially rewarded for practicing good health by abstaining from

tobacco. I pray that your lawmaking representatives will override the

governor's veto.

I salute Mississippi for the courage to attempt such an

unprecedented act.

Mike Sawyer

Executive director

I Will Never Use Tobacco, Inc. 501

Birmingham, Ala.

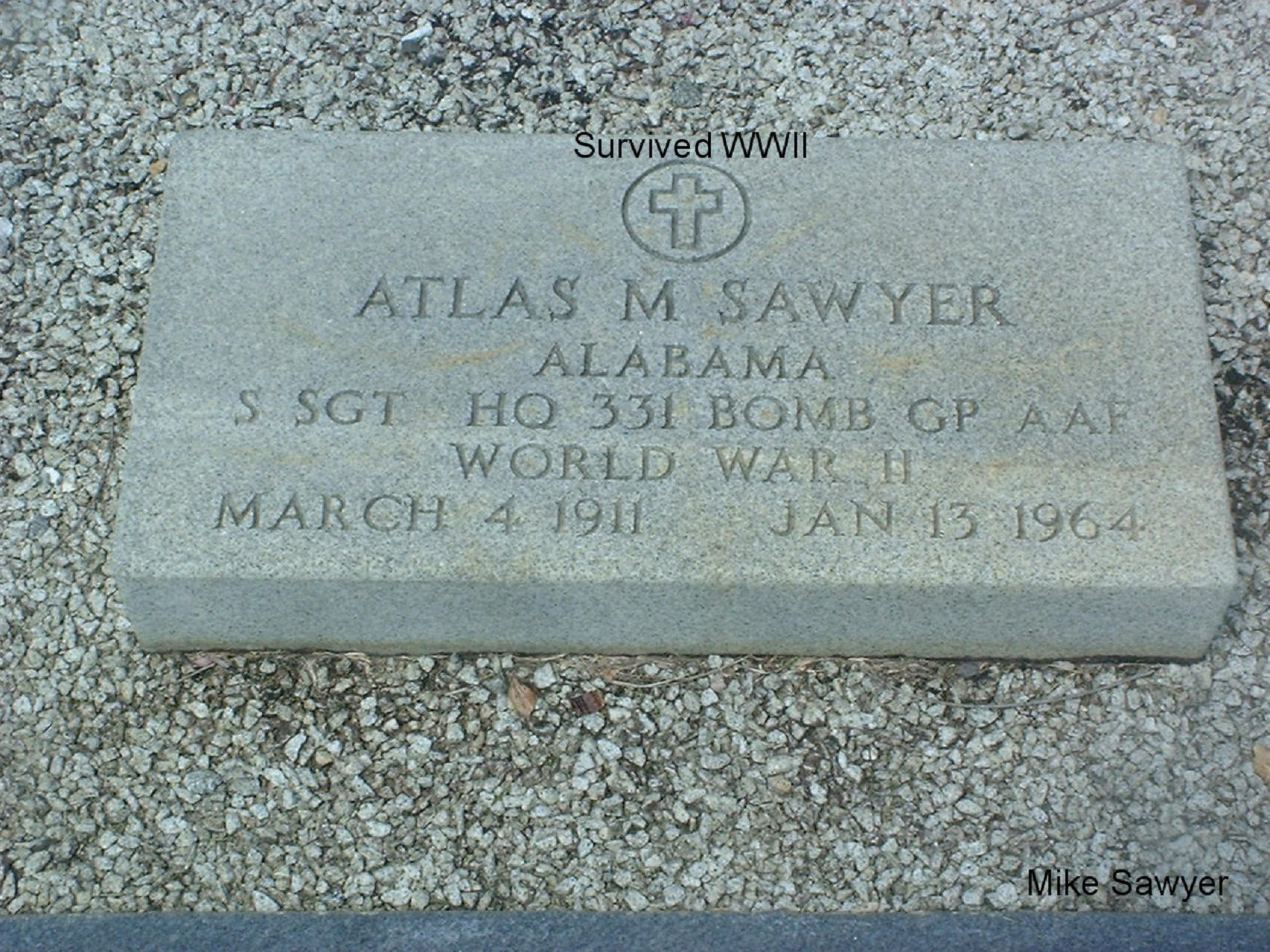

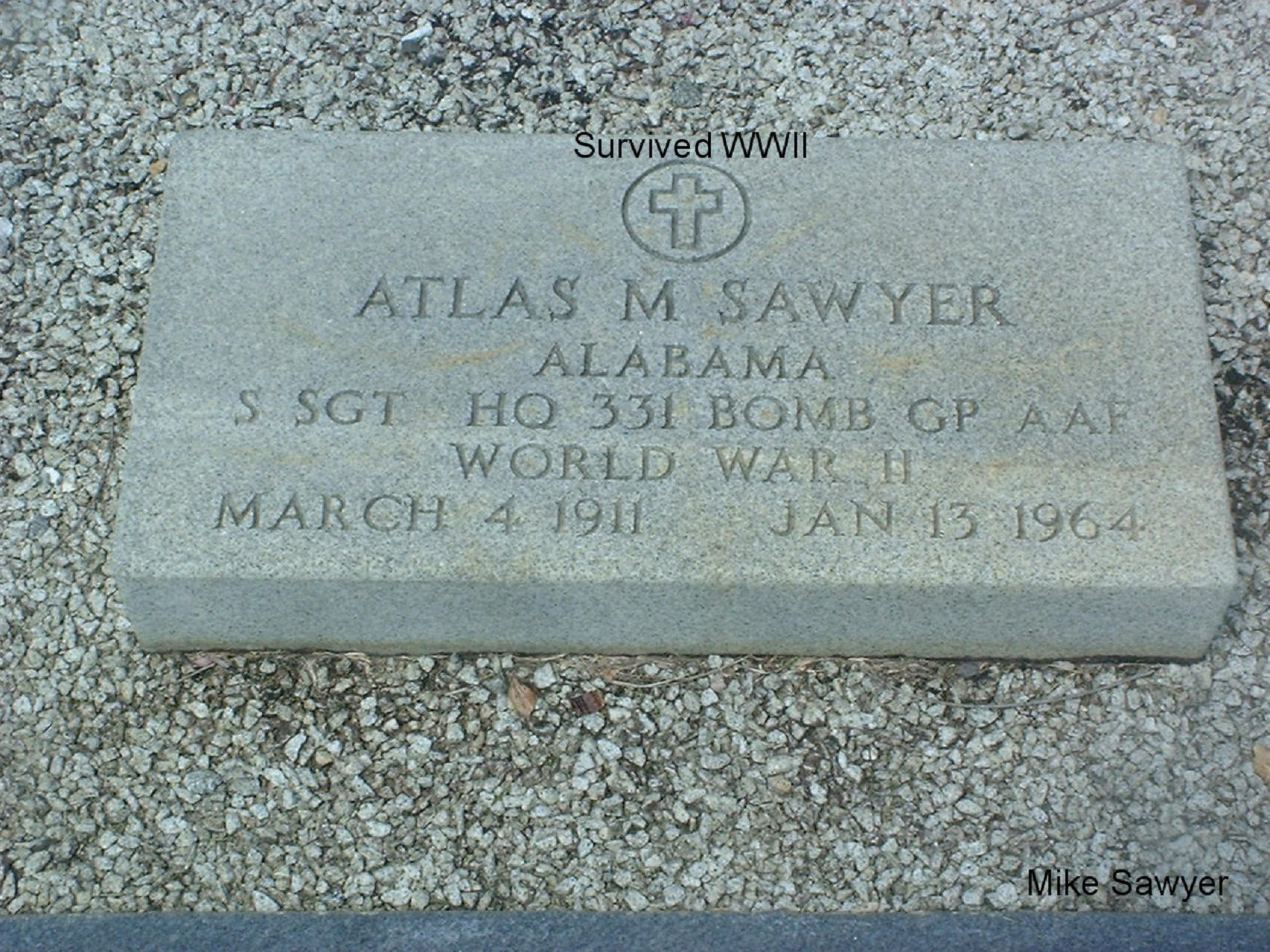

Atlas M. Sawyer survived WW II but slowly killed by his cigarettes

Please notice his date of death only two days after US Surgeon General

Luther L. Terry of Red Level, Alabama declared smoking hazard to your

health on January 11, 1964

February 15, 2006

The Southern Star Newspaper

Ozark, Alabama

"S/SGT. ATLAS M. SAWYER IS ENROUTE HOME

Pearl Harbor,T.H.

S/Sgt. Atlas M. Sawyer, husband of Mrs. Etoula L. Sawyer of Midland

City, is one of 1033 Army veterans returning to the States for discharge

aboard the U.S.S. Munda, an export carrier of the "Magic Carpet" fleet.

This ship left Saipan, January 21, and is scheduled to arrive in San

Pedro about February 5. The U.S.S. Munda was originally intended to

protect Allied supply lines in the Atlantic against German U-boats and

later was used as a transport in the Pacific."

See USS Munda

http://navysite.de/cve/cve104.htm

|

|

An e-mail from Dr. Donald F. Dohn, M.D. to

Mike Sawyer on January 20, 2006

I sent the following message to the

Clarion-Ledger editor:

Dear Mr. Hampton,

I am writing regarding Gov. Barbour's recent veto of a bill that would have

lowered grocery tax and raised tax on tobacco. I am appalled by his action, and

can't help but wonder about his reasoning especially since Mississippi's tobacco

tax ranks so low nationally.

I am a retired neurosurgeon who had a career at the Cleveland Clinic in

Cleveland, Ohio; but also practiced for seven years at the Singing River

Hospital System in Pascagoula, MS. As you can imagine, I can attest to the

damaging health factors of all forms of tobacco.

Thank you very much.

Sincerely yours,

Donald F. Dohn, M.D.

I hope your campaign has a good effect.

DFD

Mike Sawyer took this picture on the Blue Grass Parkway near Versailles,

Kentucky on February 3, 2006

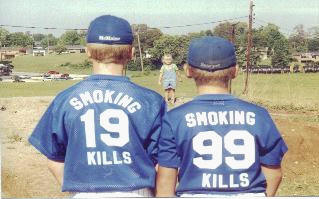

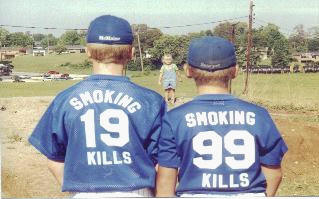

Please click to listen to Rush Limbaugh praise Mike Sawyer

for creative way of fighting kids and youth in Kentucky from smoking.

Regretfully Rush criticized Sawyer for his efforts to fight kids and youth

from smoking.

This was aired in July 1998 and replayed on first Monday of

1999.

http://FirmNotFat.com/Rush1.rm

http://FirmNotFat.com/Rush2.rm

Why would Rush Limbaugh be so against preventing kids from

becoming tobacco addicts?

Mike Sawyer on February 4, 2006

Please share your thoughts with

Mike Sawyer

for this others to read on this site.

Tobacco terrorizes 450,000 Americans to death every year per

the federal CDC